Sanchayapatra (সঞ্চয়পত্র) , also known as National Savings Certificate in Bangladesh, is regarded as the risk-free investment in Bangladesh. Over the years, it has become a part of the savings mobilization scheme of the Government of the People’s Republic of Bangladesh. Sanchayapatra (National Savings Certificate) encompasses different types of savings schemes operated by the National Savings Department, Bangladesh. This project is monitored and supervised by the Internal Resources Division of Ministry of Finance of Government of Bangladesh.

Any Bangladeshi citizen can buy the appropriate Sanchayapatra. To do so, he/she has to conform to the rules and regulations imposed by the Government. Every year, Bangladesh Bank declares the profit margins of these schemes after cutting the 5% source tax. These certificates are also sold and encased in the post offices in Bangladesh.

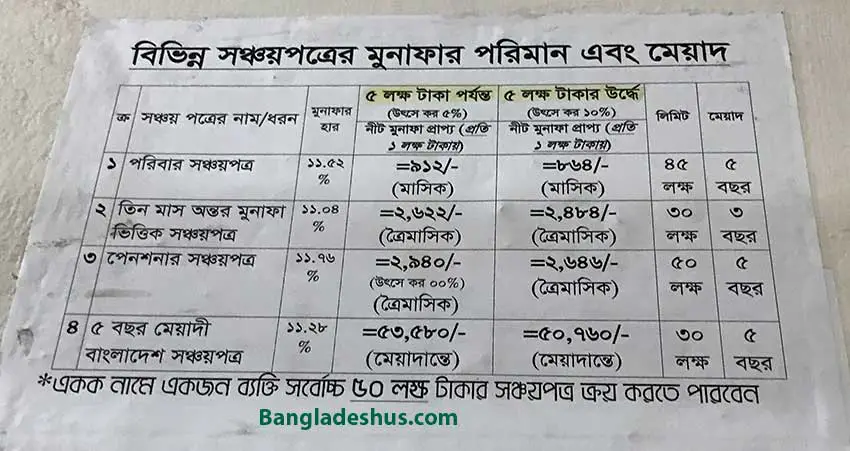

Schemes & Interest Rates of Sanchayapatra (National Savings Certificate) in Bangladesh

There are a few schemes under Sanchayapatra. They are:

- Family Saving Certificates

- Pensioner Saving Certificates

- Quarterly Profit based Savings

- Bangladesh Saving Certificates

- Wage Earner’s Saving Certificates

Family Saving Certificates: This saving scheme, also known as the Paribar Sanchayapatra. It is a 5-year long saving scheme. This scheme is specially designed for women. Any woman who is more than 18 years old can invest in Paribar Sachaypatra. The minimum investment for this scheme is Tk 10000/ and the maximum limit is Tk 45,00,000/. This schema typically provides a return of around 12.2% if encashed after maturity.

Pensioner Saving Certificates: This scheme is also known as Pensioner Sanchayapatra. Any retired government and semi-government employees who have a minimum employment period of 20 years can invest in this scheme. Generally, the returns are around 12.2% for withdrawal after 5 years. The returns vary for premature withdrawal, and it depends on the number of years of investment in the scheme.

Quarterly Profit based Savings: This scheme is known as Tin Mash ontor munafa vittik sanchaypatra. This scheme requires a minimum investment of Tk 1,00,000/- and has a maturity period of 3 years. A single person can invest a maximum of Tk 30,00,000/- and for joint owner maximum limit is Tk 60,00,000/. Generally, the returns of this scheme are around 11.8% for the complete tenure of 3 years. The returns vary for premature withdrawal, and it depends on the number of years of investment in the scheme.

Bangladesh Saving Certificates: In this scheme, the maximum investment limit is Tk 30,00,000/- for individual investors and Tk 60,00,000/- for joint investors. This is a five years scheme and provides a return of around 12.2% at maturity. The returns vary if the investor withdraws before maturity and it depends on the number of years of investment in the scheme.

Wage Earner’s Saving Certificates: This is a five years scheme, and the returns of this scheme are around 11.8% at the end of the maturation period. All the expatriate Bangladeshis and their beneficiaries and invest in this scheme.

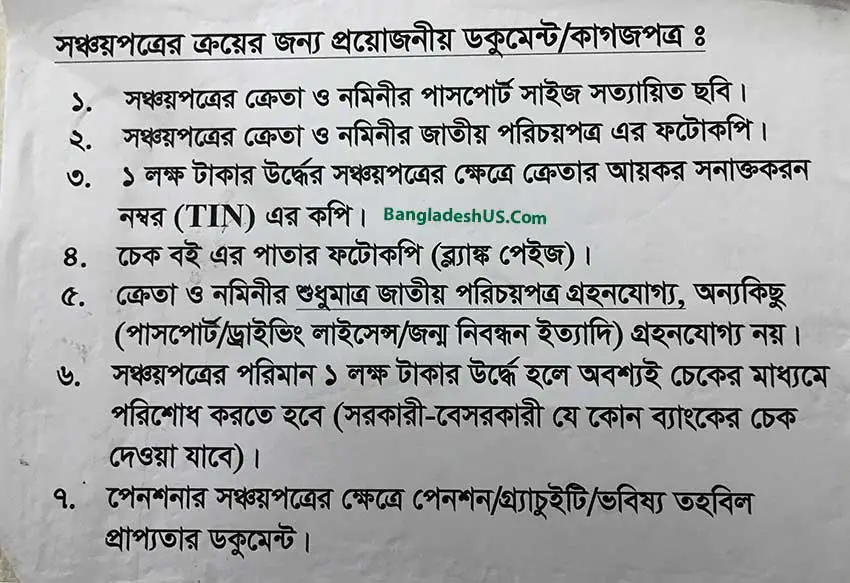

Documents Require for Opening Sanchayapatra

In order to open Sanchayapatra in Bangladesh bank, you have to submit some documents. They are:

- 2 copy passport size picture of investor

- 2 copy passport size picture of the nominee

- Photocopy of NID card of the investor

- Photocopy of NID card of the nominee

- If the investment is more than 1,00,000 Taka then a photocopy of the TIN certificate

- Photocopy of Bank cheques of the investor

How to Open Sanchayapatra Account from Bangladesh Bank

Visit the Bangladesh bank to open the Sanchayapatra Account. Go to the help desk and ask the officer about account opening procedures. The officer will give you a form. Fill up the form with the necessary information. Make sure all the information you have given is accurate. Now submit the form with proper documents to the officer. Now the officer will fill the online database form with the information you have provided in the form. After that, the issuing officer will print a payment slip and send it to the bank officer. Now the bank will verify the information, payment slip and then complete other formalities to deposit the cash. The officer will give you a Bank slip as proof of your deposit amount. After the clearance of the cheque, the investor will receive a confirmation SMS on his mobile. After receiving the SMS, the investor can get the print copy of his Sanchayapatra from the Bangladesh Bank.

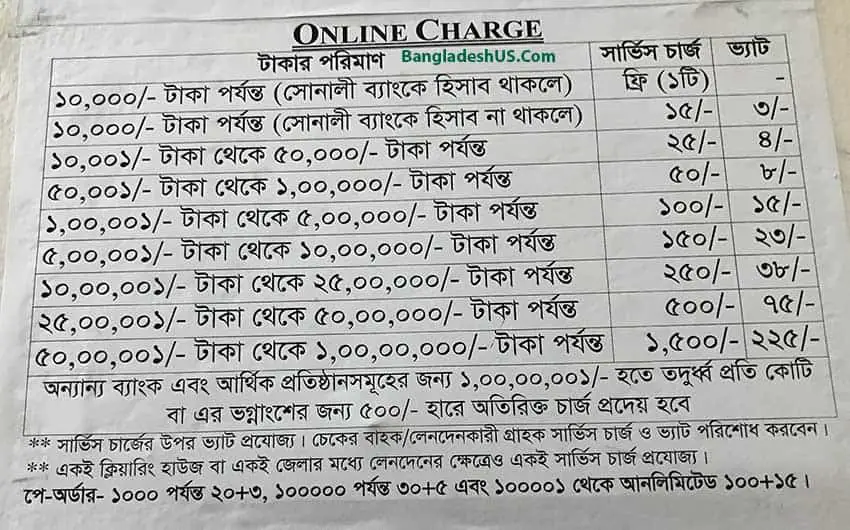

Online Charge For Sonali Bank While Opening Sanchoypotro Using Sonali Bank

Finally, I hope this article was helpful for you, and you have got the necessary information about the Sanchayapatra in Bangladesh. Don’t forget to share this article with your friends and family if you think it can help them.

Which bank sells sanchayapatra

Not every banks of Bangladesh sell Sanchaypatra. Here is a list of the official page from some private and govt-owned bank who manages the National Savings Certificate by having a direct liaison with Bangladesh Bank and Post Office.

- IFIC Bank

- HSBC Bank

- AB Bank Limited

- Mercantile Bank Limited

- Bangladesh Bank

- Agrani Bank

- Brac Bank (Don’t sell, but helps you on Sanchaypatra Encashment)

- Sonali Bank

Note: Some banks may be discontinued from such Sanchaypatra services due to sudden regulations launched from BB. So, please check with the bank before going there physically.

Reference

https://www.bb.org.bd/investfacility/sanchayapatra.php