Fixed deposit is a financial instrument offered by banks and it is a safe investment option for people who want to save money for a better future. In Bangladesh, fixed deposit is very popular because banks offer a higher rate of interest compared to a regular savings account.

Most of the banks have fixed deposit schemes and some of the best banks for fixed deposit are Bank Asia, AB Bank, City Bank, Eastern Bank, Prime Bank, UCB Bank, First Security Islami Bank, Trust Bank, Mutual Trust Bank.

If you are interested to know the details of deposit schemes of these banks then keep reading the article.

List Of Best Fixed Deposit Schemes In Bangladesh

AB Bank Fixed Deposit

AB bank has various fixed deposit facilities for their account holders. You can easily choose a fixed deposit scheme and open a fixed deposit account in AB bank. You will require a valid photo ID card, a duly filled account opening form, and two copies of recent passport size photographs.

Features Of AB Bank Fixed Deposit

- Can be opened for 1 month, 3 months, 6 months, 1 year, 2 years

- Auto-Renewable

- No restriction on the number of FDR

- Loan facility against FDR

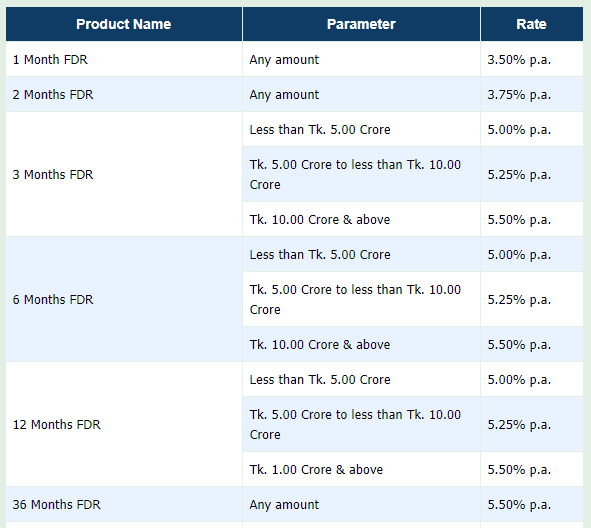

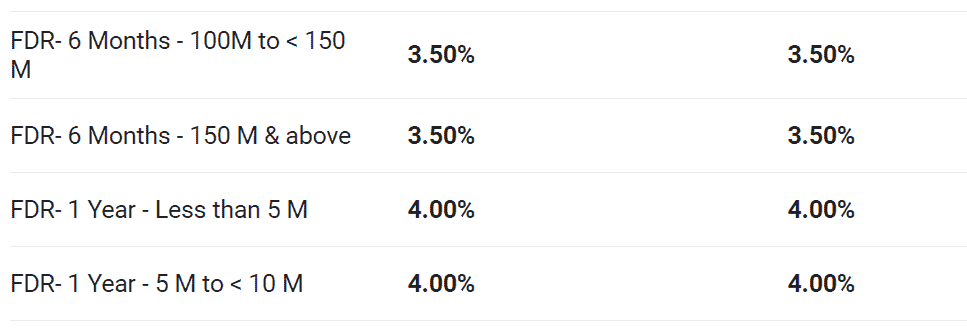

AB Bank Fixed Deposit Rates

Agrani Bank Fixed Deposit

Fixed Deposit Account Can Be Opened In The Name Of

- Individual (Single)

- Two or more persons (joint)

- Sole Proprietorship Concern

- Partnership Concern (Firm)

- Limited Companies (both Public and Private)

Required Documents

- Name of applicant(s)

- Present and Permanent Address

- Duly attested photocopy of valid National ID Card

- Two copies of recent passport size Photographs of the account holder

Required Documents For The Opening Of FDR Accounts For Joint-Stock Companies, Associations, And Clubs, Etc.

- Duplicate of Registration or Incorporation (In case of Company or registered organization)

- Duplicate of the business start date certificate (only for public limited company)

- Duplicate of Memorandum and Articles of Association (in case of the limited company), constitution and by-law (in case of association)

- Proposal of the board of directors/managing committee / governing body meeting for account management)

- Declaration

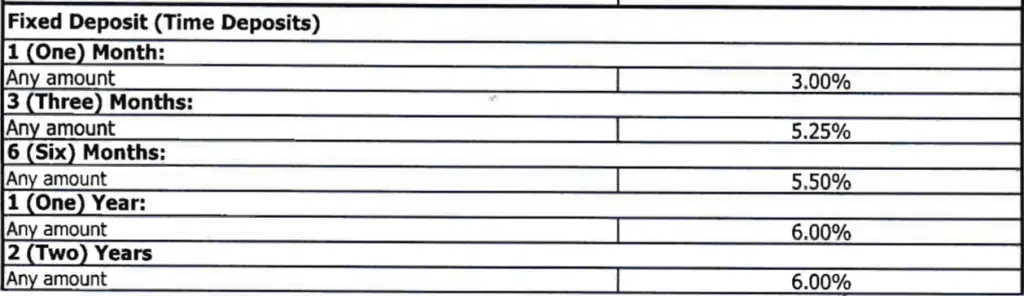

Agrani Bank Fixed Deposit Rates

- 3 Months 5.75%

- 6 Months 5.85%

- 1 Year and above 6.00%

Bank Asia Fixed Deposit

Features Of Bank Asia Fixed Deposit

- A term deposit account guarantees interest on the deposit

- Attractive interstate rate

- Flexible tenor

- Up to 90% of loan facilities

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

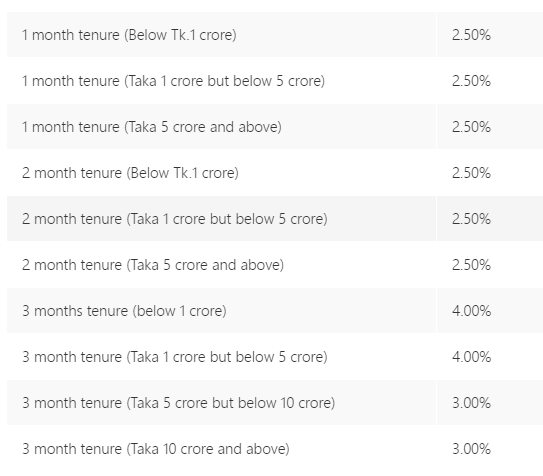

Bank Asia Fixed Deposit Rate

City Bank Fixed Deposit

Eligibility

- Age: At least 18 years

- Nationality: Bangladeshi

Features

- Can open for 1 Month, 3 Months, 6 Months, 1 Year, 2 Years & 3 Years

- Early encashment facility

- Loan facility on the deposited amount

Required Documents

- NID/Birth certificate/Passport

- Photograph – 2 Copies

- Nominee photograph – 1 Copy

- Nominee’s NID/Birth certificate/Passport

- Income source document

- E-TIN

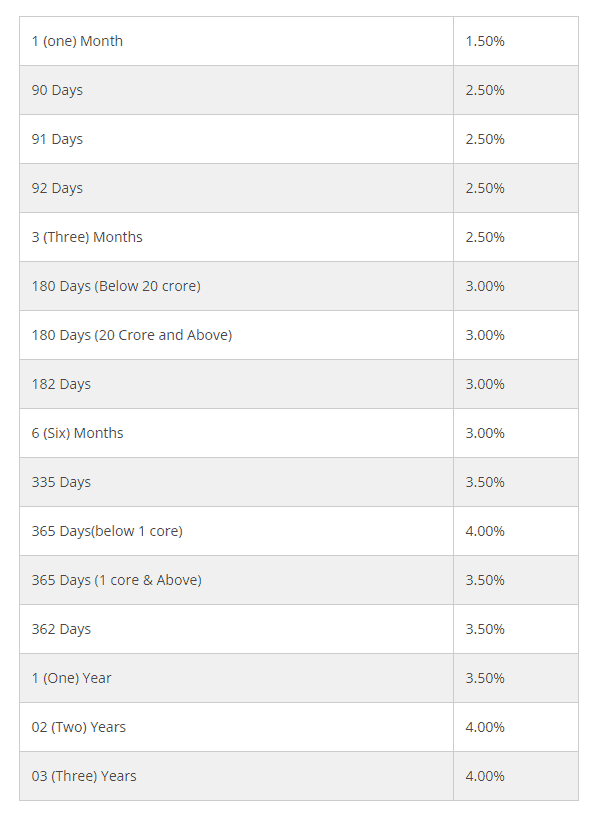

City Bank Fixed Deposit Rate

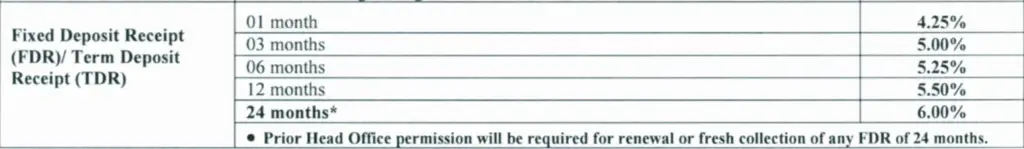

BASIC Bank Fixed Deposit

Eligibility

- Age: At least 18 years

- Nationality: Bangladeshi

Required Documents

- NID/Birth certificate/Passport

- Photograph – 2 Copies

- Nominee photograph – 1 Copy

- Nominee’s NID/Birth certificate/Passport

- Income source document

- E-TIN

BASIC Bank Fixed Deposit Rate

Dhaka Bank Fixed Deposit

Eligibility

- Age: At least 18 years

- Nationality: Bangladeshi

Features

- Minimum Required Deposit: Tk. 50,000.00

- Tenure: Minimum 1 Month and Maximum 2 Years (Provision for Auto-Renewal)

- Interest Rate (Maximum) : 5.00%

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

Dhaka Bank Fixed Deposit Rate

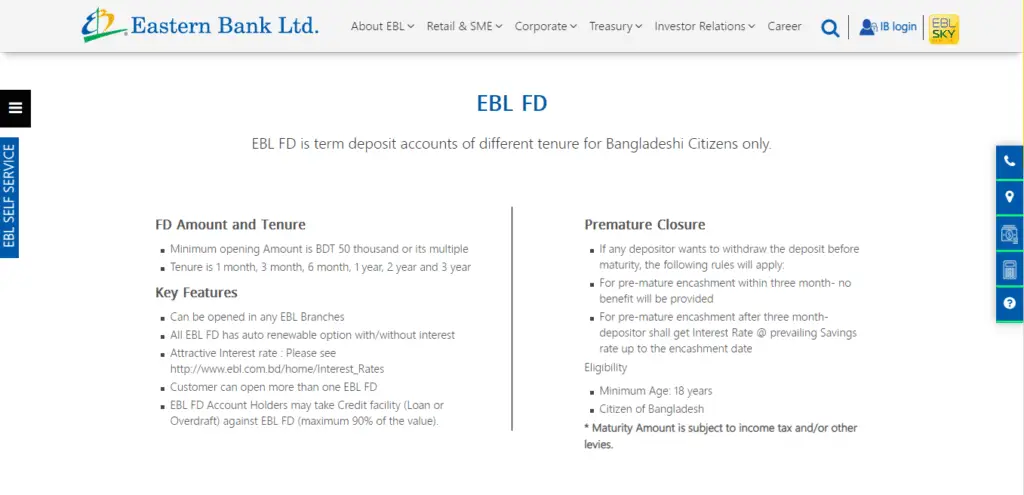

Eastern Bank Fixed Deposit

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Fixed Deposit Amount and Tenure

- The minimum opening Amount is BDT 50 thousand or its multiple

- Tenure is 1 month, 3 months, 6 months, 1 year, 2 years, and 3 year

Features

- Can be opened in any EBL Branches

- All EBL FD has an auto-renewable option with/without interest

- Attractive Interest rate: Please see http://www.ebl.com.bd/home/Interest_Rates

- Customer can open more than one EBL FD

- EBL FD Account Holders may take Credit facility (Loan or Overdraft) against EBL FD (maximum 90% of the value)

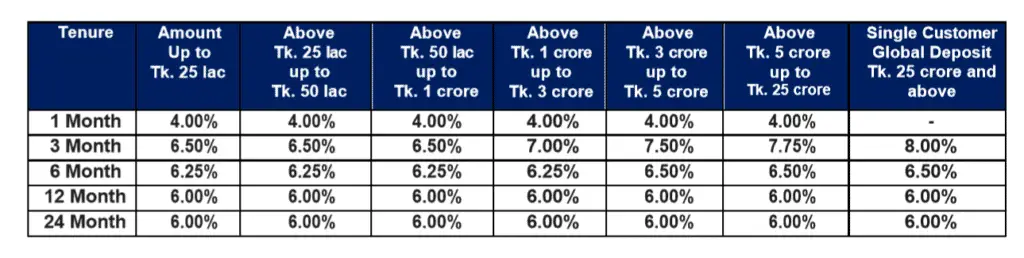

Eastern Bank Fixed Deposit Rate

Prime Bank Fixed Deposit

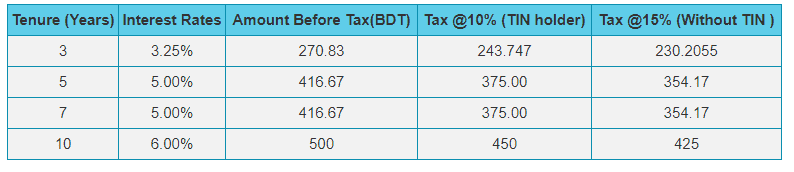

Features

- Attractive rate of return

- Maturity tenures of 3, 5, 7, or 10 years.

- One person can open more than one “Monthly Benefit Deposit Scheme”

- Loan/overdraft facility against the deposited amount

- Free eye checkup facility for the scheme holder at Prime Bank Eye Hospital

Eligibility

- Age: At least 18 years

- Nationality: Bangladeshi

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

Prime Bank Fixed Deposit Rate

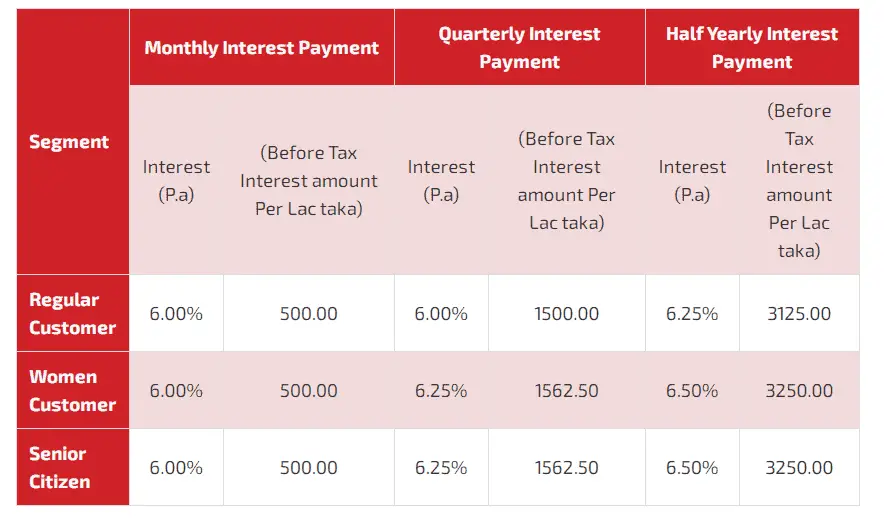

UCB Bank Fixed Deposit

Features

- Monthly / Quarterly / Half-Yearly Interest Payment

- Open with a minimum of 50,000 taka with no upper limit

- Flexible tenor from 3 to 10 years

- Preferential Interest Rate for Senior Citizens (60 years & above)

- Interest will be credited automatically to UCB Current/Savings Account. Stand Alone UEPFD is NOT ALLOWED. Customer must have to open/have a linked account (either Current/Savings Account with UCB)

- Fulfill urgent financial requirements without breaking the FD by availing credit facility up to 80% of the deposit

- Automatic renewal of the FD

- Partial Encashment of the FD is not allowed

- 24/7 instant access to link account balance through any VISA/MasterCard ATM all over the country

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

UCB Bank Fixed Deposit Rate

NRB Bank Fixed Deposit

Features

- Attractive Interest Rates

- Auto-renewable option with/without interest

- A single customer can open more than one Term Deposit

- Both single & joint account opening option available

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

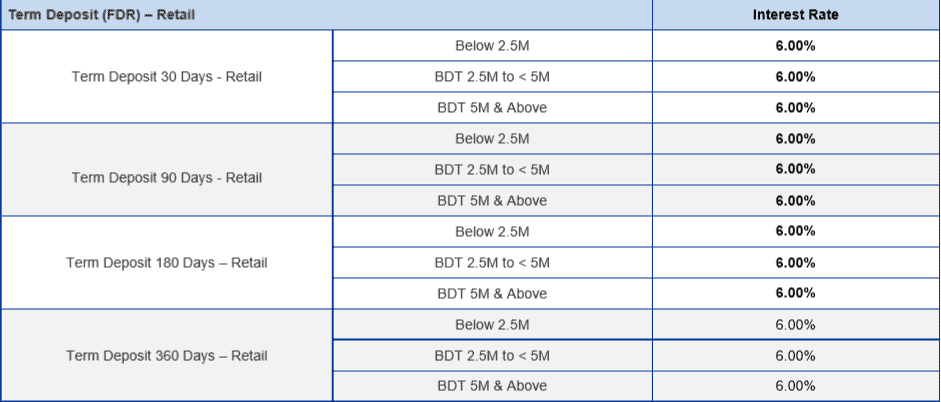

NRB Bank Fixed Deposit Rate

FSIBL Fixed Deposit

Features

- One time Deposit start from 25,000/- or it’s multiple

- Tenure: 1, 2, & 3 Years

- Profit paid every month

- Applicants have to maintain a savings account and profit will be transferred automatically to a savings account on monthly

- Attractive profit rate

- The scheme will not be auto-renewal

Required Documents

- One copy passport size photograph of the applicant

- One copy passport size photograph of the nominee (photograph to be attested by the applicant)

- Photocopies of National ID Card/Passport/Driving License of both applicant and nominee

- TIN Certificate (if applicable)

- Introducer (in case of new account applicant and/or applicable)

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

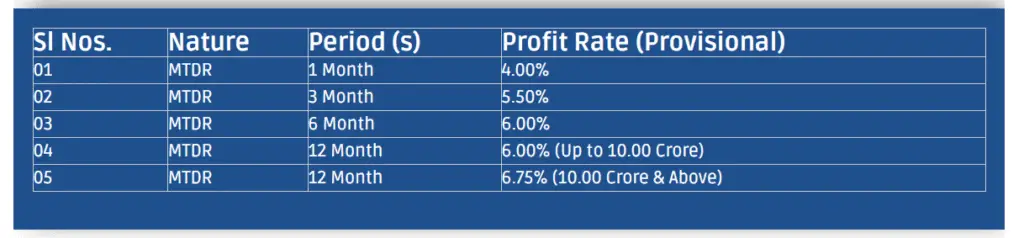

FSIBL Fixed Deposit Rate

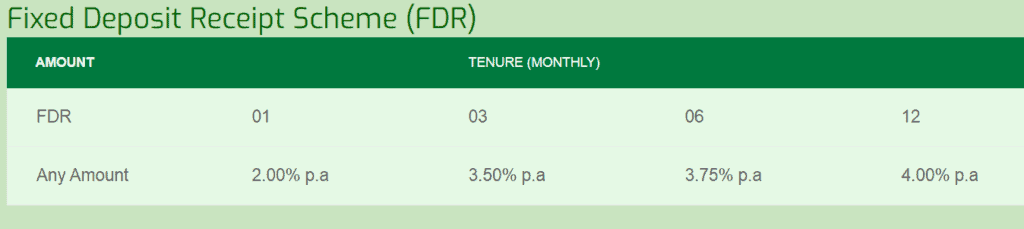

Trust Bank Fixed Deposit

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

Features

- Money can grow with an attractive interest rate with flexible tenure

- FDR can be opened for 1 month, 3 Months, 6 Months, 12 months

- Automatic renewal facility at maturity

- Loan facility against FDS to meet urgent financial needs

- The customer may avail of loan facilities against FDS as a security

- Premature closure facility at the savings rate

Trust Bank Fixed Deposit Rate

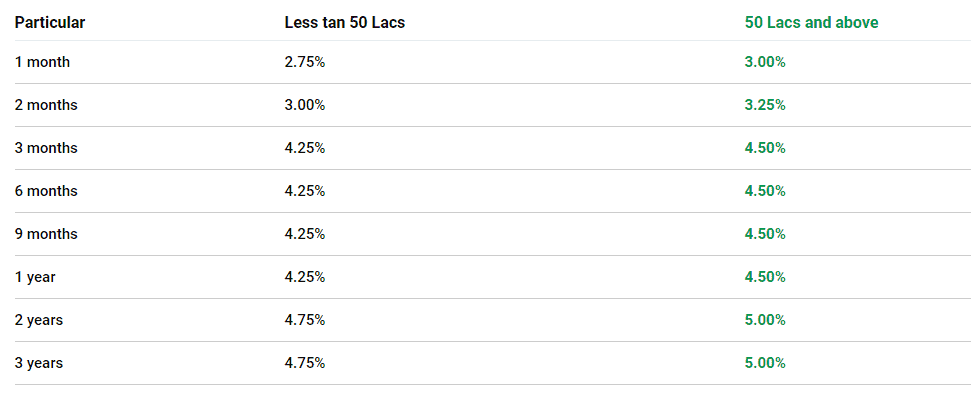

Mutual Trust Bank Fixed Deposit

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Features

- Can be opened for 1 month, 2 Months, 3 months, 6 months, 9 months, 1 year, 2 years

- Auto-Renewable

- No restriction on the number of FDR

- Loan facility against FDR

Mutual Trust Bank Fixed Deposit Rate

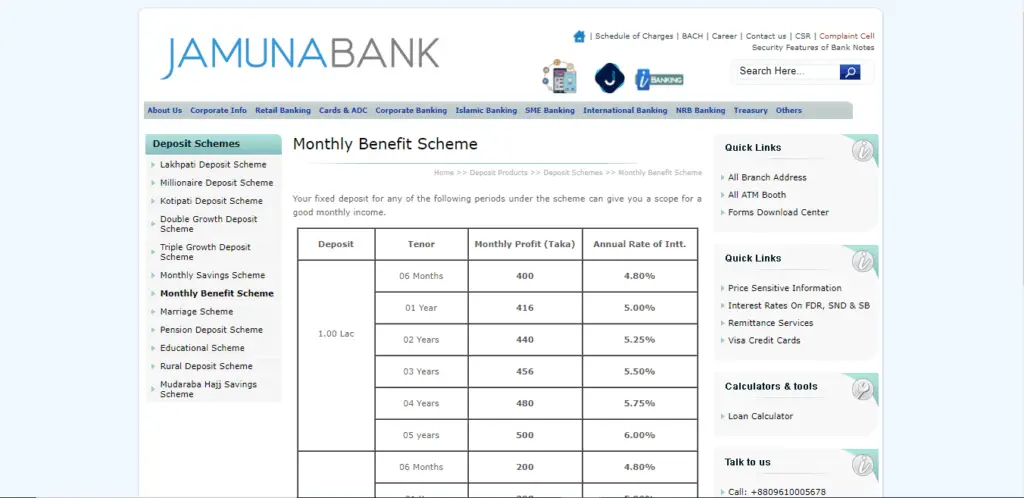

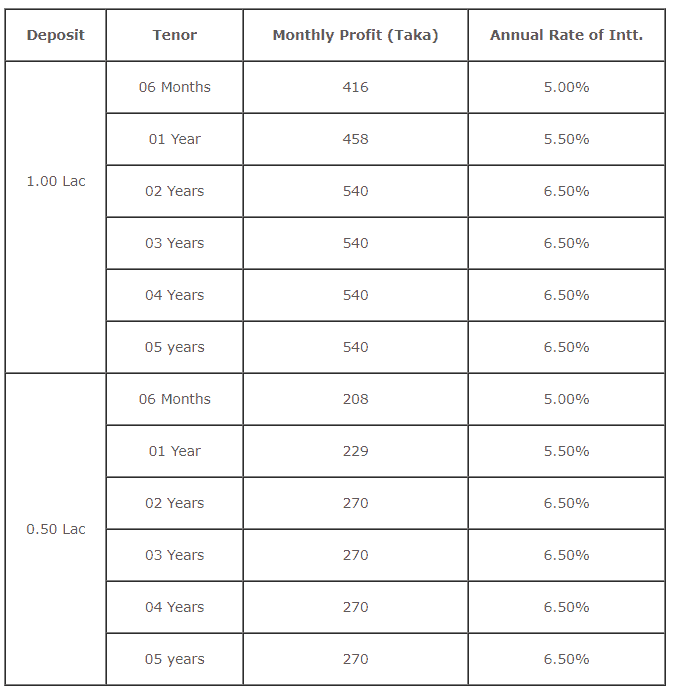

Jamuna Bank Fixed Deposit

Features

- If you need money, you can take a loan at the bank’s suitable terms and condition

- In case of pre tenor encashment of the scheme, you can still get the attractive benefit

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Required Documents

- One copy passport size photograph of the applicant

- One copy passport size photograph of the nominee (photograph to be attested by the applicant)

- Photocopies of National ID Card/Passport/Driving License of both applicant and nominee

- TIN Certificate (if applicable)

- Introducer (in case of new account applicant and/or applicable)

Jamuna Bank Fixed Deposit Rate

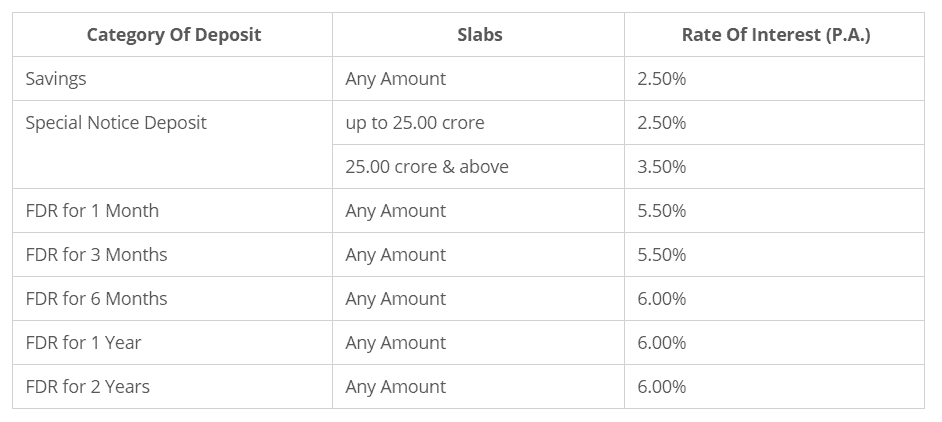

National Bank Limited Fixed Deposit

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Required Documents

- Account Opening Form

- Photo ID/ National ID/ Passport / Driving License of Customer & Nominee(s)

- Recent photograph of customer & Nominee(s)

- Proof of Address

- Signed Terms & Conditions

- TIN Certificate (if applicable)

National Bank Limited Fixed Deposit Rate

Premier Bank Fixed Deposit

Features

- Can be opened for 1M, 2M, 3M, 100 Days, 4M, 6M, 12M, 13M

- Early encashment possible

- Up to 90% loan facility on the deposited amount

Eligibility

- Minimum Age: 18 years

- Citizen of Bangladesh

Document Required

- Photograph of A/c holder – 2 copies

- Photocopy of Valid NID/Passport/Driving License

- Photograph of Nominee – 1 copy

- CASA link Account for all FD

Premier Bank Fixed Deposit Rate